Direct Indexing: Checking the Box

The Impact of Exclusion

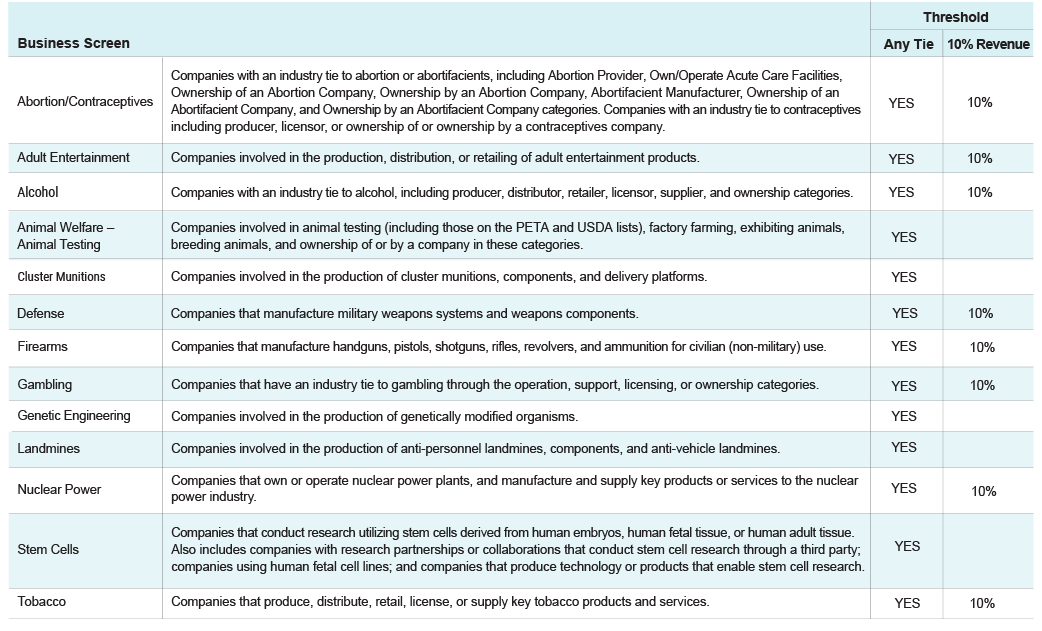

Business involvement screens examine the businesses that a company engages in so that portfolios can be constructed to exclude companies generating revenue or profits from activities clients wish to avoid. Natixis Direct Indexing offers 13 standard business involvement screens (see Table 1). But often, when investors “check the box” to exclude certain activities, they may not fully understand the impact it will have on the portfolio. This article hopes to shed some light on the topic.

Table 1 – Business Involvement Screens

Source: Natixis Investment Managers Solutions

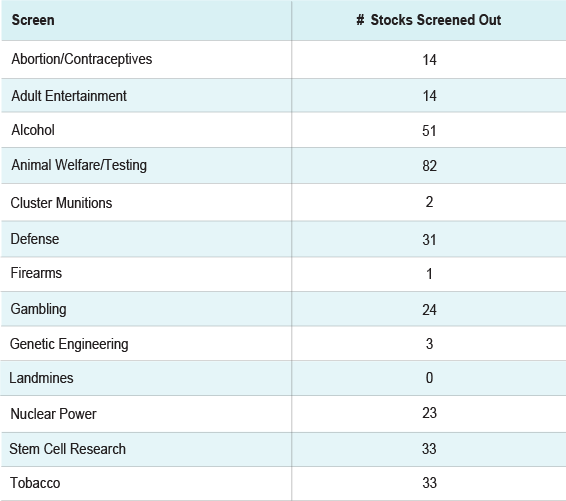

The answer may surprise you. It’s just one: Walmart. That’s the only company in the S&P 500® that has any connection to “handguns, pistols, shotguns, rifles, revolvers, and ammunition for civilian (non-military) use” since they sell guns and ammo in some stores. Most publicly traded firearms manufacturers are small- and mid-cap companies or domiciled outside the US. While an investor might feel strongly about avoiding firearms, it has little impact on the investable universe.

Which Stocks Are Screened Out?

Conversely, a vegetarian and dog owner might be inclined to check the box to exclude companies involved in animal testing. As Table 2 shows, that choice will have a significant impact on the opportunity set. Over 15% of the S&P 500® constituents – or 82 stocks – are “involved in animal testing (including those on the PETA and USDA lists), factory farming, exhibiting animals, breeding animals, and ownership of or by a company in these categories,” with about half of those in the Health Care sector.

Table 2 – Impact of Individual Screens on S&P 500®

Source: Natixis Investment Managers Solutions

Investors can apply a strict screen, a relaxed screen, or mix and match. Notice that Table 1 has two columns – “Any Tie” and “Revenue” thresholds. The strict screen is referred to as “Any Tie,” which means a company has any connection to that activity. The relaxed screen uses a 10% revenue threshold, meaning a company would have to generate at least 10% of its revenue from that activity to be excluded. Natixis Direct Indexing relies on data from MSCI to determine which companies are excluded by each screen.

Any Tie vs. 10% Revenue

Let’s look at an example to draw a distinction between these two options. Under the stricter “Any Tie” threshold, a company would be excluded if they have any involvement either directly or indirectly, with a particular type of activity. For example, Delta Air Lines would be excluded from the manager’s investable universe, based on the Alcohol screen, because they offer alcohol for sale onboard flights.

With the more relaxed “10% Revenue” threshold, a company will be excluded if they generate a meaningful amount of their business through that activity, but would not be excluded if they receive a de minimis portion of revenues from it. For example, Delta Air Lines would not be excluded based on the Alcohol screen because they only derive 0.2% of their revenue from alcohol sales onboard flights.

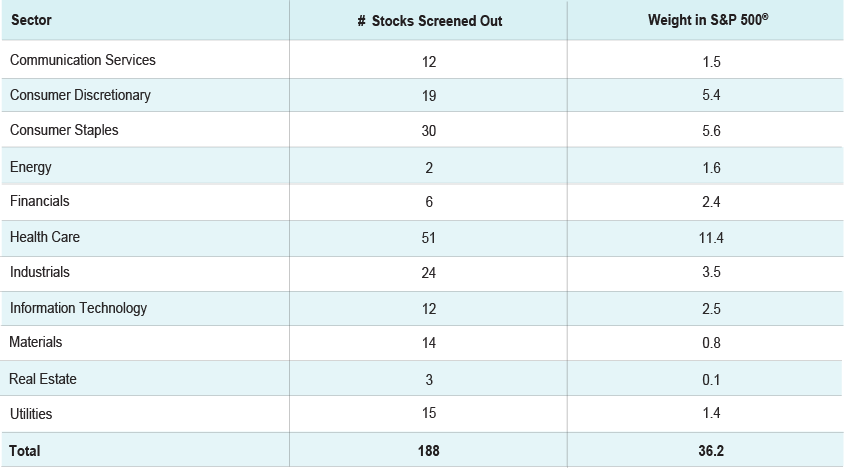

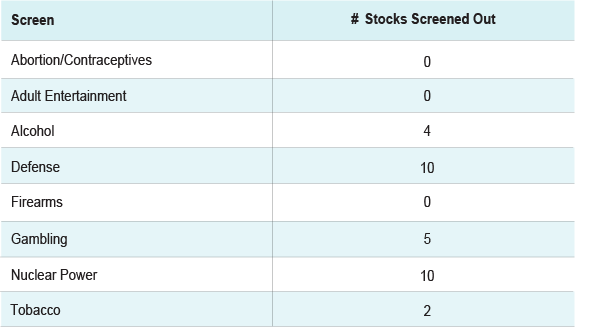

The impact of “Any Tie” vs. “10% Revenue” is significant. If an investor were to apply all 13 screens simultaneously under the strict criteria, 188 of the S&P 500® stocks would be excluded from the investable universe as shown in Table 3. But the relaxed revenue threshold, which is available for 8 of the 13 options, takes much of the bite out of the results. This pure-play option, which doesn’t punish incidental activities, reduces the investable universe by just 31 names (see Table 4).

Table 3 – Excluding S&P 500® Stocks with “Any Tie”, by Sector

Source: Natixis Investment Managers Solutions

Table 4 – Excluding S&P 500® Stocks with 10% Revenue, by Screen

Source: Natixis Investment Managers Solutions

What About Comms and Tech?

Another interesting point is that the impact of these screens is minimal on the two darling sectors of the market today – Communication Services and Technology. Both sectors are up over 40% in the past year, outperforming the S&P 500® by over 10%. Tight restrictions on these sectors may have a meaningful impact on overall returns. But as Table 3 illustrates, only 4% of the 38% in these sectors are impacted. Of the so-called Magnificent Seven stocks – Nvidia, Meta, Amazon, Microsoft, Google, Apple, and Tesla – only Amazon is an offender as a retailer of alcohol (think: Whole Foods) and adult entertainment products.

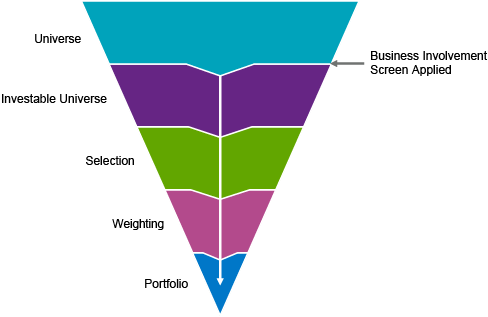

Direct Indexing portfolios, which seek to track an index’s return pre-tax and outperform it after-tax, have the flexibility to align with investors’ personal values. After selecting an index to track, the investor can further personalize the opportunity set by applying exclusionary business involvement screens. But personalizing an index by reducing the investable universe may lead to returns that differ from the index – either positive or negative. Knowing the potential impact of applying a screen helps investors make more informed decisions.

Direct Indexing Security Selection Process

This material is provided for informational purposes only and should not be construed as investment advice. Investors should not make choices solely on the content contained herein, nor should they rely on this information to apply to their specific situation or any specific investments under consideration. This is not a solicitation to buy or sell any specific security.

Although Natixis Investment Managers Solutions believes the information provided in this material to be reliable, it does not guarantee the accuracy, adequacy, or completeness of such information.

6531717.1.1

Allocating to Emerging Markets? Consider These Factors.

Allocating to Emerging Markets? Consider These Factors.