Tax Management Update – Q1 2024

The number of stocks in the S&P 500® posting positive returns during Q1 came in at approximately 73% – a good deal higher than the 64% that we saw for the full year 2023.

Equity markets began 2024 with very strong performance with stocks rising dramatically during the first quarter. The good-sized increase in markets was driven by a number of factors, including strong corporate earnings and a stabilization in both interest rates and inflation. Speculation around Fed rate cuts and interest rates, more generally, remains a key variable. The market is still expecting rate cuts later in the year, although the frequency and aggressiveness of rate reductions will likely be less than previously forecast.

Tax code changes likely on hold

Meaningful change to the tax code will likely not take place until after the election and the range of potential outcomes is quite wide depending on who wins. A Democratic sweep would likely lead to an increase in taxes on the wealthy and corporations. A Republican sweep would potentially see a very different outcome, with lower tax rates on corporations and less dramatic personal tax rate changes. A divided government might see little to no change, given the differing views and priorities.

More winners than losers

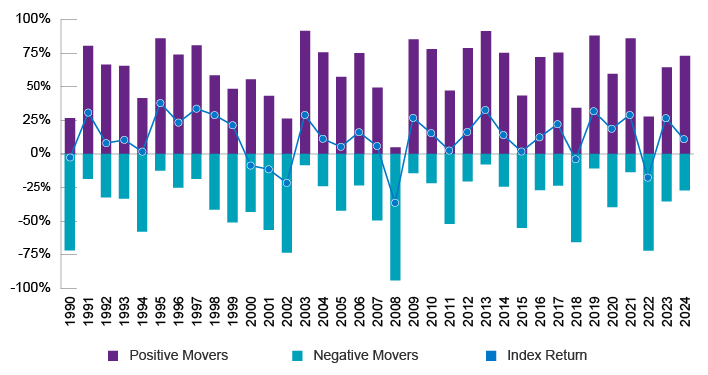

The number of stocks in the S&P 500® posting positive returns during Q1 came in at approximately 73%, which is a good deal higher than the 64% figure that we saw for the full year 2023. Given this broad-based strength in the market, we saw the S&P 500® post a 10.6% return. In the past couple of decades, in years where the market is up 10-15% the number of stocks with positive returns has tended to be around 75%. So unlike 2023 where a relatively small number of mega cap stocks drove performance, Q1 strength was a good deal more evenly distributed. With that said, some of the highfliers from the past couple of years continue to post excellent returns, with NVIDIA (+82%) and Meta (+37%) performing especially well year to date.

Winners, losers, and total return for the S&P 500® by calendar year (3/31/24)

Source: FactSet, Natixis Investment Managers Solutions

Source: FactSet, Natixis Investment Managers SolutionsPerformance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

Loss harvesting opportunities in shorter supply

Q1 2024 represented a somewhat muted period from a tax loss harvesting perspective. Stocks generally ended 2023 at elevated levels, and then a broad-based advance during the first quarter tended to move them up higher. Dispersion of returns across individual companies came down somewhat, with only 27% of S&P 500® companies falling in value over the course of Q1. This company-specific dispersion (when accessed via a separately managed account) still provides some opportunities for harvesting, as investors oftentimes have at least some exposure to underperforming names. This harvesting opportunity varies quite a bit based on client-specific events (when the client invested, cash flows, etc.) along with manager changes, but generally speaking, equity and fixed income portfolios tended to have some opportunities to harvest losses in Q1.

Resource

Tax Management Update Q1 2024

Read Full Update

Tax-Efficient Investing in Separately Managed Accounts (SMAs)

Direct Indexing SMAs can help address key issues facing tax-sensitive investors. All accounts are actively managed to optimize tax loss harvesting while providing beta exposure to an index. Our tax-managed SMAs include:

Learn More

Want more information on tax-managed investment strategies?

Contact Us

What Is Tax Loss Harvesting?

A portfolio can harvest its losses for tax purposes by selling investments when their current value is less than the price originally paid for the security. These losses can be used to offset other capital gains on an investor’s tax return. If there are excess losses, they can be used to offset up to $3,000 in ordinary income – or be banked for use in future years.

Capital gain is a rise in the value of a capital asset (investment or real estate) that gives it a higher worth than the purchase price.

CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.

The S&P 500® Index is a widely recognized measure of US stock market performance. It is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation, among other factors. It also measures the performance of the large-cap segment of the US equities market.

The views and opinions expressed may change based on market and other conditions. This material is provided for informational purposes only and should not be construed as investment advice. There can be no assurance that developments will transpire as forecasted. Actual results may vary.

Indexes are not investments, do not incur fees and expenses and are not professionally managed. It is not possible to invest directly in an index.

Investing involves risk, including risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided.

This document may contain references to copyrights, indexes and trademarks that may not be registered in all jurisdictions. Third-party registrations are the property of their respective owners and are not affiliated with Natixis Investment Managers or any of its related or affiliated companies (collectively “Natixis”). Such third-party owners do not sponsor, endorse or participate in the provision of any Natixis services, funds or other financial products.

6536581.1.1

Direct Indexing: Checking the Box

Direct Indexing: Checking the Box